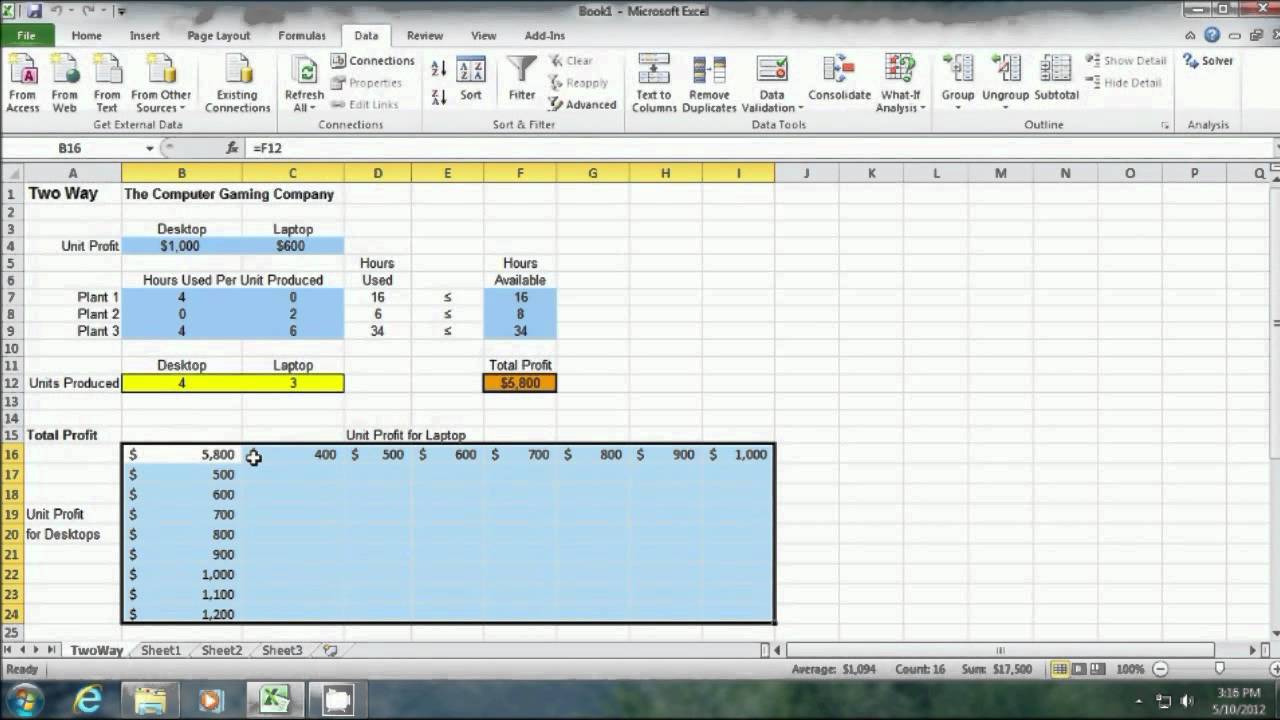

Your working capital of $1,200,000 limits the number of lots and houses you can annually sell because every lot requires a $50,000 cash investment and every house requires a $25,000 cash investment. To continue with the fictional case of residential development, suppose that you have two principal limiting fac- tors: working capital and bulldozer capacity. Of course, any objective function is limited by certain constraints. Your princi- pal financial objective is to maximize your profits, and this objective can be expressed as an objective function, or equation, that you want to maximize: Suppose that you make $20,000 on each home you build and $15,000 on each building lot you develop and then sell. You create and sell two products: building lots and houses.

Suppose, for example, that you’re a residential real estate developer and contractor. EasyRefresher: How Optimization Modeling Works While this abstract definition sounds complicated, at least at the conceptual level, optimization modeling makes common sense once you provide a concrete example.

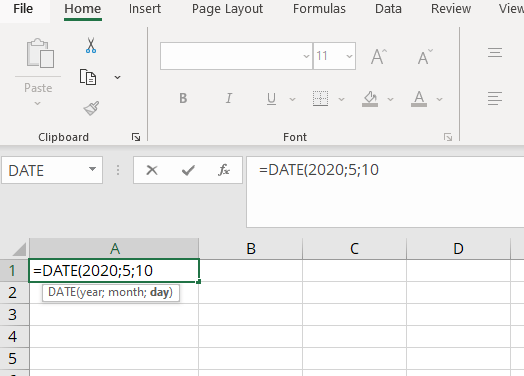

With an optimization-modeling problem, you want to optimize an objective function but at the same time recognize that there are constraints, or limits. Excel’s Solver tool lets you solve optimization-modeling problems, also commonly known as linear programming programs.

0 kommentar(er)

0 kommentar(er)